Gold Stock Canada: If you’re an investor looking to diversify your portfolio, gold stocks in Canada can be a promising option. With the current market trends and economic uncertainties, investing in gold stocks can provide a hedge against inflation and market volatility. In this article, we’ll discuss some top gold stock picks in Canada that investors should consider for potential growth and stability in their investment portfolio.

Top gold stock picks in Canada for investors include companies such as Barrick Gold Corporation, Newmont Corporation, Agnico Eagle Mines Limited, and Kinross Gold Corporation. These companies have proven track records in the gold industry and are well-positioned to benefit from rising gold prices. Investors looking to capitalize on the potential upside of the gold market may consider adding these stocks to their portfolios. It is important to conduct thorough research and consider factors such as company performance, financial health, and market conditions before making investment decisions.

The Rise and Fall of Gold Stock Canada

Investors looking to diversify their portfolios often turn to the precious metals market, and Gold Stock Canada is a popular choice. With its stability and potential for high returns, gold stock in Canada offers opportunities for both long-term and short-term investors. However, it’s essential to understand the market trends, political factors, and risks associated with gold stock in Canada before making any investment decisions. It’s also crucial to stay informed about the best companies and the future of gold stock in Canada, especially in today’s rapidly changing world.

The Rise and Fall of Gold Stock Canada is a documentary that explores the history of the gold stock market in Canada. It delves into the factors that led to the rise of gold stock investments in the country, as well as the eventual decline of the market. The documentary examines the impact of economic, political, and social factors on the gold stock market and provides insight into the trajectory of the industry. Additionally, it features interviews with experts and industry insiders to provide a comprehensive view of the rise and fall of gold stock in Canada.

Investing in Gold Stock Canada: A Beginner’s Guide

Investing in Gold Stock Canada: A Beginner’s Guide provides a comprehensive overview of the basics of investing in gold stocks in the Canadian market. The guide covers topics such as the factors influencing gold prices, different methods of investing in gold stocks, and key considerations for beginners entering the market. It also delves into the potential benefits and risks of investing in gold stocks, as well as tips for selecting the right gold stocks to add to a portfolio. This resource can be particularly helpful for individuals who are new to investing in the gold sector and seeking to understand the Canadian market.

Analyzing the Pros and Cons of Gold Stock Canada

Analyzing the pros and cons of investing in gold stock in Canada involves examining various factors. Some potential pros include the potential for hedging against inflation, geopolitical instability, and currency devaluation. Gold stocks may also provide diversification in an investment portfolio and have historically been a store of value. However, cons may include volatility in gold prices, regulatory risks, and potential for underperformance compared to other asset classes. It’s important to conduct thorough research and consider individual financial goals and risk tolerance before investing in gold stocks in Canada.

The Best Gold Stock Canada Companies to Watch

Some of the top gold stock companies to watch in Canada include Barrick Gold Corporation, Newmont Corporation, Kinross Gold Corporation, and Yamana Gold Inc. These companies are major players in the gold industry and are known for their strong financial performance, large production scale, and potential for growth. Additionally, they have a strong portfolio of mines and projects in stable jurisdictions, which further adds to their attractiveness as investment options. When considering gold stock investments in Canada, these companies are definitely worth keeping an eye on.

Understanding the Market Trends of Gold Stock Canada

Understanding the market trends of gold stock in Canada involves analyzing various factors such as supply and demand dynamics, global economic conditions, geopolitical events, and currency fluctuations. Additionally, factors like production costs, mining regulations, and industry developments are critical in assessing the performance and potential of gold stocks in Canada. It is also essential to monitor gold prices, investor sentiment, and the overall performance of the mining sector to make informed decisions regarding gold stock investment in Canada.

Maximizing Profits with Gold Stock Canada Investments

Maximizing profits with gold stock Canada investments involves conducting thorough research and analysis of the market and the specific companies you are interested in. It is important to understand the factors that influence the price of gold, as well as the financial health and potential growth of the gold mining companies in which you are investing.

Diversification is also a key strategy for maximizing profits with gold stock investments. By spreading your investments across multiple companies, you can reduce your risk exposure and potentially increase your overall returns. Additionally, staying informed about market trends and geopolitical factors that may affect the price of gold can help you make informed investment decisions.

It is also important to closely monitor your investments and be prepared to adjust your strategies based on market changes. Utilizing the expertise of financial advisors and staying informed about the latest market developments can also be beneficial for maximizing profits with gold stock Canada investments.

How Political Factors Impact Gold Stock Canada

Political factors can have a significant impact on the gold stock in Canada. For example, changes in government policies and regulations, such as taxation, trade agreements, and environmental laws, can affect the mining industry and ultimately impact the gold stock. Additionally, political instability and geopolitical tensions can also influence investor sentiment and market volatility, which in turn can affect the price of gold and gold stocks in Canada. Therefore, staying abreast of political developments and their potential impact on the mining and precious metals industries is crucial for investors in the gold stock market.

The Future of Gold Stock Canada in a Post-Pandemic World

The future of gold stock Canada in a post-pandemic world is uncertain, as the market continues to be impacted by economic instability and shifts in global supply and demand. While gold has historically been seen as a safe haven investment during times of crisis, the long-term effects of the pandemic on global economies and financial markets are still not fully known.

It is expected that gold stock in Canada will continue to be influenced by factors such as inflation, interest rates, and geopolitical tensions. Additionally, the recovery of industries such as mining and exploration will play a significant role in the performance of gold stocks in the country.

Investors are advised to closely monitor market trends and seek guidance from financial experts when considering gold stock investments in the post-pandemic world. Overall, the future of gold stocks in Canada will depend on a complex interplay of economic, political, and social factors as the world emerges from the pandemic.

Evaluating the Risks and Rewards of Gold Stock Canada

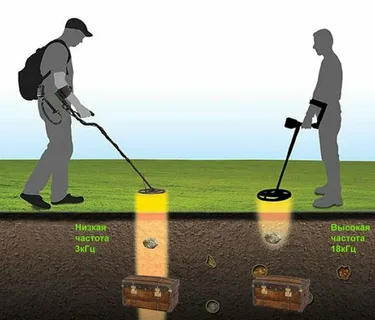

See also: gold detector

Evaluating the risks and rewards of gold stock in Canada involves analyzing various factors such as the current price of gold, the performance of the company, and market trends. Investors need to consider the potential for price fluctuations in the gold market, as well as geopolitical and economic factors that can impact the industry. On the reward side, gold stocks have the potential for significant returns, especially during times of economic uncertainty or inflation. However, it is important to carefully weigh these potential rewards against the risks before making any investment decisions. Conducting thorough research and seeking guidance from financial experts can help in making informed investment choices.

Navigating the Volatility of Gold Stock Canada Markets

Navigating the volatility of gold stock markets in Canada can be a challenging task, as the price of gold is influenced by numerous factors, including economic conditions, geopolitical events, and market speculation. Investors in gold stocks need to closely monitor these factors and be prepared for sudden price fluctuations. It is important to conduct thorough research and stay informed about the latest developments in the gold market. Additionally, diversifying your investment portfolio and having a long-term strategy can help mitigate the risks associated with investing in gold stocks. Overall, navigating the volatility of gold stock markets in Canada requires careful analysis and strategic decision-making.